Source: istockphoto.com

As medical costs continue to rise and unexpected illnesses or accidents can strike at any moment, having adequate health insurance has become a crucial aspect of protecting ourselves and our families. Yet, determining the right level of coverage can often feel complicated, leaving many unsure about what constitutes sufficient health insurance.

Moreover, in wealth management and financial planning, a crucial aspect that often finds itself overlooked is Risk Management. While individuals diligently plan for their investments, savings, and retirement, the significance of mitigating risk with respect to health is sometimes underestimated. Additionally the impact of medical inflation needs to be taken into account while planning for risk.

While researching for this article, we noticed that data for medical inflation in India is extremely difficult to procure in the public domain. Most countries have a health care index, however India does not have one. Also, there is no clear historical data of India’s medical inflation.

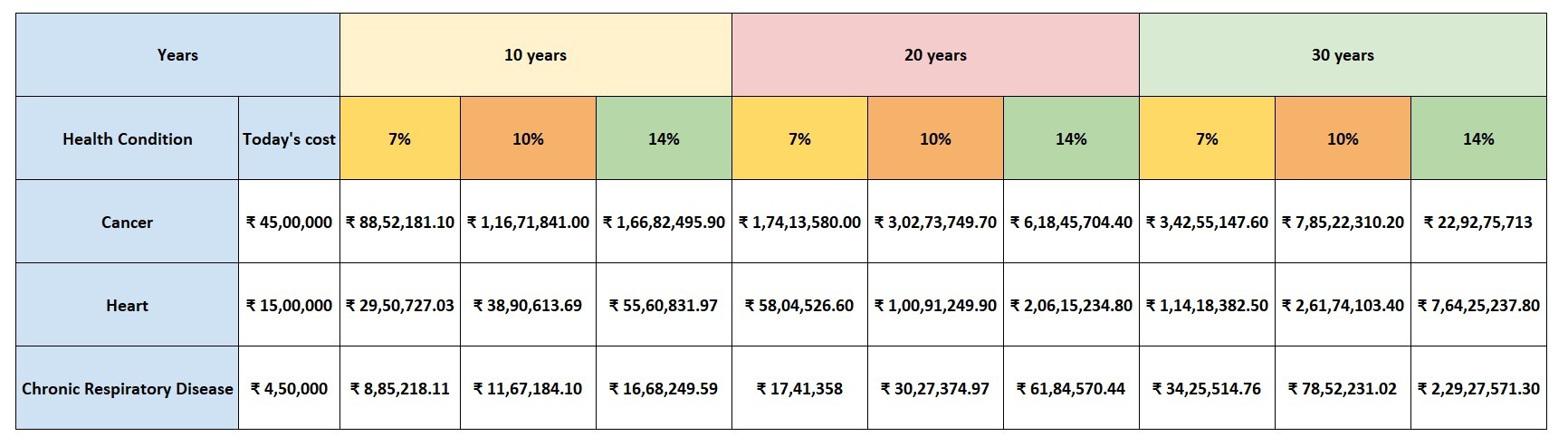

We have collated data and have constructed a table for you to understand the projected cost of certain health conditions which are expected to increase significantly in the coming years. To demonstrate the potential impact of medical inflation on healthcare expenses, we utilized current health costs and incorporated different inflation rates. Let us consider 3 cases to analyze how medical expenses may escalate over time -

All medical costs taken below are anecdotal.

In the above table, we can see the healthcare expenses at different inflation rates for various time periods.

Let's take a health condition (cancer) to see what the expense at different time periods will be for an inflation rate of 14%. We have taken the current cost of treatment as 45 lakhs. In 10 years, the estimated cost for cancer treatment would increase to 1.6 crores. Looking further ahead, the cost is expected to increase significantly to approximately 6 crores in 20 years and a substantial 22 crores in 30 years.

Please Note- that the numbers presented here are based on anecdotal data sourced from the internet. Although not precise, they do offer a glimpse of how Medical Inflation can erode the value of insurance coverage over time. This increase in medical inflation in India can be attributed to the following factors:

Despite high medical inflation, it is crucial to ensure that our health insurance is keeping up with the rising cost of healthcare services. As people are living longer, there is a greater need for comprehensive health insurance to manage potential medical expenses during their later years and it is strenuous to find any supporting data that we can refer to in order to know what coverage is actually sufficient for us.

In light of the article presented, we may be adequately covered for today, but the question is if we are adequately covered for tomorrow?

Note by: Pragya Patni

Future Corp Capital

28th July, 2023

Disclaimer: The data/information compilation in this article is the Author’s comment on general trends in the securities market and discussions of broad-based indices. The information/data provided here is not a research report as defined under the Securities and Exchange Board of India (Research Analysts) Regulations, 2014 (SEBI RA Regulation, 2014). Thus, the Author is not required to have registration as a Research Analyst under the SEBI RA Regulation, 2014.

The information/data provided in this article is from publicly available data, and appropriate references have been given, which we believe are reliable. While reasonable endeavours have been made to present reliable data related to current and historical information, the Author does not guarantee the accuracy or completeness of the data/ information in this article. Accordingly, the Author or any of his connected persons, including his associates or employees, shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information/data contained, views and opinions expressed in this article.

The information/data provided in the article is purely for information purposes and to disseminate knowledge on the general trends in the securities market. The same does not constitute investment recommendation/advice or an offer or solicitation of an offer to buy/sell any securities.

No person should rely solely on the information/data in this article and must make investment decisions based on their own investment objectives, judgment, risk profile and financial position. The recipients of the article may take necessary professional advice before acting on it.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.